Income Tax: What happens if employee fails to pick between new and old tax regime? CBDT notification instructs employers how to deduct tax in such cases

Income Tax, Default Tax Regime: Employers will have to take ascent from their employees regarding their choice to opt for new tax regime or the old tax regime.

Income Tax, Default Tax Regime: Central Board of Direct Taxes (CBDT) has issued a notification with regards to the new income tax regime, informing that if any employee fails to mention their preference between the new and the old tax regime, then the employer will have to deduct income tax as per the newer tax regime.

However, the CBDT notification further adds that when it comes to income tax, the onus will lie on the employer to deduct tax as per either of the two taxation regimes whichever applies to the employees. And the employers will have to take ascent from their employees regarding their choice to opt for new tax regime or the old tax regime.

Finance Minister Nirmala Sitharaman had announced in her Budget speech that the new tax regime would be the "default" tax regime for income tax payers from FY2023-24. Although this development did not make anything mandatory - as taxpayers still had the option to opt for the old tax regime for their income tax assessement, and it only meant that those looking to opt for the old tax regime would have to select it on the IT department's portal, else they would be assessed under the new tax regime by default.

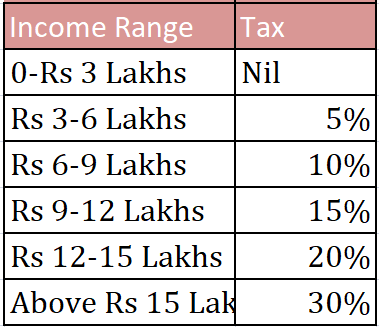

SLABS UNDER NEW TAX REGIME

In her Budget 2023-24 speech, she also announced changes to the new optional tax regime to ensure that effectively no tax would be payable for anyone whose taxable income does not exceed Rs 7 lakh.

In a departure from no exemptions on investments under the new optional tax regime, she also allowed taxpayers to claim a standard deduction of Rs 50,000. This move was seen as an attempt to make the new tax regime more lucrative for salaried classes.

Watch the video on the new tax regime here

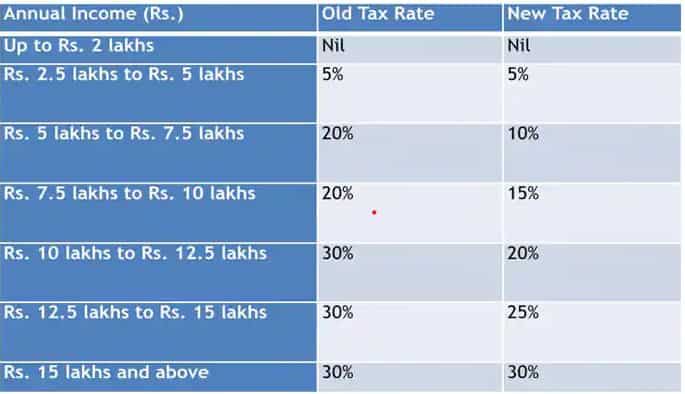

Apart from extending the benefit of standard deduction, the Budget also raised the exemption limit and changed the tax rates a bit to make make the new regime more attractive to taxpayers.

Originally introduced in 2020-21, the new tax regime has now been revamped to ensure that no tax would be levied for income up to Rs 3 lakh.

Income between Rs 3-6 lakh would be taxed at 5 per cent; Rs 6-9 lakh at 10 per cent, Rs 9-12 lakh at 15 per cent, Rs 12-15 lakh at 20 per cent and income of Rs 15 lakh and above will be taxed at 30 per cent. "The new tax rates are 0 to Rs 3 lakhs - nil, Rs 3 to 6 lakhs - 5%, Rs 6 to 9 Lakhs - 10%, Rs 9 to 12 Lakhs - 15%, Rs 12 to 15 Lakhs - 20% and above 15 Lakhs - 30%," the Finance Minister said in her Budget speech.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SIP Calculation at 12% Annualised Return: Rs 10,000 monthly SIP for 20 years, Rs 15,000 for 15 or Rs 20,000 for 10, which do you think works best?

FD Rates for Rs 10 lakh investment: Compare SBI, PNB, HDFC, ICICI, and Post Office 5-year fixed deposit returns

LIC Saral Pension Plan: How much should you invest one time to get Rs 64,000 annual pension for life?

SIP Calculation at 12% Annualised Return: Rs 1,000 monthly SIP for 20 years, Rs 4,000 for 5 years or Rs 10,000 for 2 years, which do you think works best?

UPS vs NPS vs OPS: Last-drawn basic salary Rs 90,000 and pensionable service 27 years? What can be your monthly pension in each scheme?

Monthly Pension Calculations: Is your basic pension Rs 26,000, Rs 38,000, or Rs 47,000? Know what can be your total pension as per latest DR rates

09:44 AM IST

CBDT's nudge campaign: Over 30,000 taxpayers declare foreign assets, income worth about Rs 30,300 crore

CBDT's nudge campaign: Over 30,000 taxpayers declare foreign assets, income worth about Rs 30,300 crore Fact Check: Are senior citizens above 75 years old exempt from paying taxes?

Fact Check: Are senior citizens above 75 years old exempt from paying taxes? Baijayant Panda to chair Select Committee on Income-Tax Bill

Baijayant Panda to chair Select Committee on Income-Tax Bill Income Tax department activates section wise mapping of I-T Act, Tax bill

Income Tax department activates section wise mapping of I-T Act, Tax bill  New Income Tax Bill 2025: What changes, what remains, and how it may impact taxpayers

New Income Tax Bill 2025: What changes, what remains, and how it may impact taxpayers